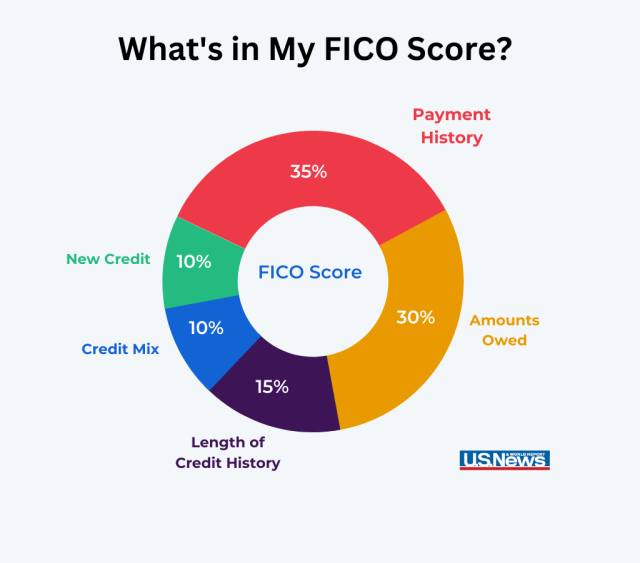

FICO SCORE. Let's talk about. How is yours?

DID YOU KNOW 90% of lending decisions rely on FICO credit scores?! Here's a quick reference on how they grade: 300 = poor; 580 = fair; 670 = good; 740 = very good; and 800+ = excellent.

Payment History is key. I was taught to pay everything off every single month, in full, on time or early/before the due date. An even better habit is to figure out WHEN the 3 major credit bureaus pull reports and to pay off any balances BEFORE that date so when they run your balance it's $0'd out. This is also why how much you spend versus how much your credit card limit is, matters. IE: if you have a credit card limit of $5k and you spent $2500 on that card (or max it out).

If you have a credit card, or maybe a few then chances are one of your card benefits is monitoring your FICO score. I highly recommend checking it out and playing around with your pay offs -- I'm willing to bet you will see positive change in as quick as 1-3 months with these changes. *I say that because I actually do it.

BOTTOM LINE: If you have credit that could use some boosting or overall repair, please consider reaching out to me for a confidential conversation. I have a team of professionals who help clean + boost FICO scores for a living.

HERE is a quick read of an article you might find interesting!

Payment History is key. I was taught to pay everything off every single month, in full, on time or early/before the due date. An even better habit is to figure out WHEN the 3 major credit bureaus pull reports and to pay off any balances BEFORE that date so when they run your balance it's $0'd out. This is also why how much you spend versus how much your credit card limit is, matters. IE: if you have a credit card limit of $5k and you spent $2500 on that card (or max it out).

If you have a credit card, or maybe a few then chances are one of your card benefits is monitoring your FICO score. I highly recommend checking it out and playing around with your pay offs -- I'm willing to bet you will see positive change in as quick as 1-3 months with these changes. *I say that because I actually do it.

BOTTOM LINE: If you have credit that could use some boosting or overall repair, please consider reaching out to me for a confidential conversation. I have a team of professionals who help clean + boost FICO scores for a living.

HERE is a quick read of an article you might find interesting!

Categories

Recent Posts

"Experience the power of collaboration with Jenn and her Team of highly successful, experienced professionals who focus obsessively on the details—your unique needs, process, transactional excellence, and exceeding expectations. With an exceptional reputation, you gain access to decades of resources, connections, and industry expertise, ensuring you can confidently and successfully navigate all your real estate needs. "